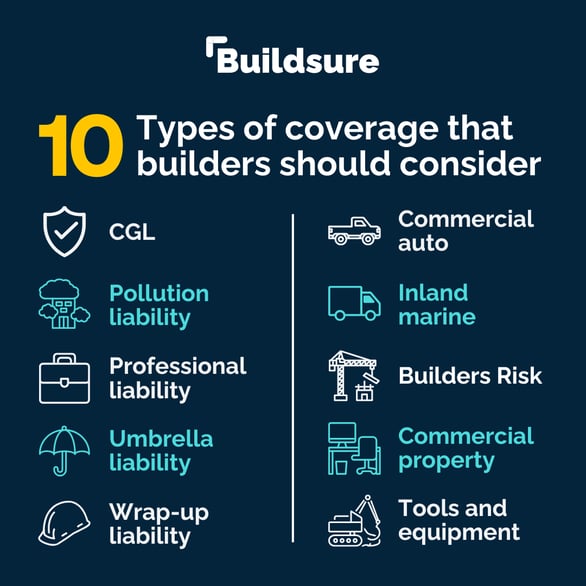

What types of insurance should a construction company have?

Depending on your company's unique needs, there is a wide spectrum of coverage that you should consider. A construction-specializing insurance broker can help you determine the coverage you need while helping your company save money by eliminating unnecessary additions. These areas of coverage offer protection for your company's vehicles, property and tools, while also helping cover liabilities and other business risks.

1. CGL

Commercial general liability (CGL) policies provide coverage for claims of third-party bodily injury and property damage caused by your company, resulting from negligence or accidents.

When legal repercussions occur, your CGL policy covers the damages awarded against you and any legal fees.

2. Pollution liability

Pollution liability insurance (also known as environmental impairment liability insurance) policies help protect businesses in the case of third-party claims and first-party exposures, when these are caused by pollution which resulted from the covered operations that your business performs, or on behalf of your company. Claims could be for environmental impacts, injuries or for damage to property.

3. Professional liability

Businesses use professional liability insurance to protect against negligence claims such as an error or omission. Professionals from many industries, especially professionals who contract their services, often use this insurance.

4. Umbrella liability

Also known as excess liability insurance, umbrella liability helps pay damages in the event of a lawsuit that exceeds their normal coverage limits.

Other coverages to explore: Legal expenses, subcontractor default, business interruption.

5. Wrap-up liability

Wrap-up liability insurance extends liability coverage to include contractors and subcontractors that have been used to work on a job or project. This type of coverage can be purchased by both the owner of the project or the contractor, or even purchased jointly.

6. Commercial auto

Commercial auto insurance policies in Ontario include these mandatory coverages:

- Third-party liability

- DCPD (direct compensation-property damage)

- Accident benefits

- Uninsured auto

Additional auto coverage can be added on to cover perils not included in the list of mandatory coverages.

7. Inland marine

Inland marine insurance shields your business against potential losses or damages to equipment, machinery, merchandise, or other assets during transportation over land. This coverage extends to items used at job sites, stored in warehouses, or transported via train or truck between locations.

8. Builders Risk

Builders risk insurance, also called course of construction insurance, is designed to protect the asset during the construction phase of the project.

While protecting against financial loss is reason enough to carry builders risk insurance, many construction contracts require it as a condition of the agreement. Having builders risk policy in place demonstrates compliance with contractual obligations and mitigates potential legal disputes or penalties.

Other coverages to explore: Contractors E&O, construction bonds, installation floater.

9. Commercial property

Commercial property insurance offers protection for the physical assets and property used in business operations. It safeguards businesses from financial losses caused by damage or destruction of property due to risks like fire, theft, vandalism, or natural disasters.

10. Tools and equipment

This insurance helps cover the cost of tools and equipment, which can be important especially as most commercial auto policies will not cover the cost of replacing tools damaged while in transit (for example between job sites).

How much does insurance for a construction company cost?

It depends on many factors, as all businesses are unique. It’s best to consult an insurance broker and discuss the below:

- Your business location and jobsite locations.

- How many years the business is established and experience

- Your operating expenses and payroll, in case of business interruption.

- Bonding requirements according to contracts.

- Insurance and claims history.

What is the best insurance for a construction company?

The best insurance for a construction company is a combination of coverages that suit your business' unique needs. Buildsure, for example, always applies a combination of commercial general liability insurance, builders risk insurance (also called course of construction insurance), commercial auto insurance, tools and equipment insurance, pollution liability insurance, and surety bonds for construction.

Where can I buy insurance for my construction company?

You can only purchase insurance for your construction company through a licensed insurance broker who has access to the specific insurance products that you want to get. Considering exploring your options? We’d be happy to assist, we offer a suite of construction insurance products tailored to your construction needs. Buildsure, is customized specially for construction companies and homebuilders.

October 30, 2024 at 4:08 PM